Generic drugs are supposed to be cheaper. Everyone knows that. But here’s the twist: not all generics are created equal. Some cost 15 times more than other drugs that do the exact same thing. And if you’re managing a health plan, a hospital formulary, or even just trying to save money on your own prescriptions, that gap matters - a lot.

Why generics aren’t always the bargain they seem

The idea behind generics is simple: when a brand-name drug’s patent expires, other companies can make the same medicine at a fraction of the cost. The FDA says that when the first generic hits the market, prices drop by nearly 40%. When six or more generics are available, prices plunge more than 95% below the original brand price. That sounds like a win. But here’s what’s not being talked about enough: within the generic market itself, there are huge price differences. A 2022 study in JAMA Network Open looked at the top 1,000 most-prescribed generic drugs in the U.S. and found that 45 of them were priced way higher than other drugs in the same therapeutic class - drugs that worked just as well. One example? A generic version of a common blood pressure medication was selling for $1,200 per month, while another generic - chemically identical in effect - cost just $77. That’s a 15.6x difference. These aren’t mistakes. They’re market failures. And they’re costing the system billions.How cost-effectiveness analysis (CEA) uncovers hidden savings

Cost-effectiveness analysis (CEA) is the tool that helps cut through the noise. It doesn’t just look at the sticker price. It asks: What do we get for every dollar spent? The metric used most often is the incremental cost-effectiveness ratio, or ICER. It measures how much extra it costs to gain one extra quality-adjusted life year (QALY) - basically, one more year of healthy life. For generics, CEA compares the cost of one drug against another with the same clinical outcome. If Drug A costs $500 and gives you the same result as Drug B at $30, the CEA says: choose Drug B. Simple. But here’s where most analyses fail. A 2021 ISPOR conference report found that 94% of published CEA studies don’t even try to predict what will happen when new generics enter the market. They look at today’s prices - but ignore tomorrow’s. That’s like deciding whether to buy a car based only on its current price, without checking if a better model is coming out next month. The result? Health systems keep paying for expensive generics because their decision tools are outdated. And that’s not just inefficient - it’s wasteful.Therapeutic substitution: the overlooked shortcut to savings

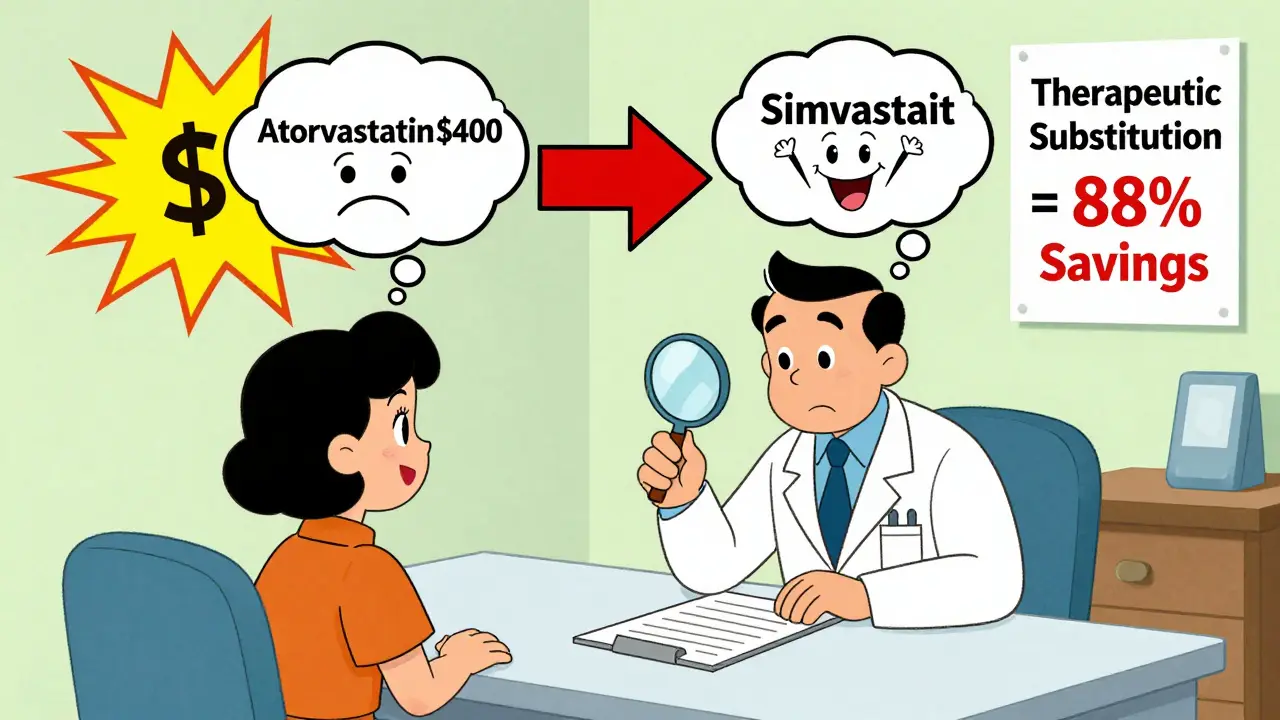

You don’t always need to switch to the cheapest generic of the same drug. Sometimes, the best move is to switch to a different drug in the same class. Take statins, for example. Atorvastatin and rosuvastatin are both used to lower cholesterol. One might be branded. Another might be generic. But if you compare two different generics - say, simvastatin vs. atorvastatin - you might find that simvastatin works just as well and costs 20 times less. That’s therapeutic substitution: swapping one drug for another with the same purpose, not just one generic for another. The JAMA study showed that when you substitute high-cost generics with lower-cost therapeutic alternatives, you can cut spending by up to 88%. In one case, total spending on 45 high-cost generics dropped from $7.5 million to just $873,711. That’s not a rounding error. That’s real money that could pay for screenings, mental health services, or insulin for people who can’t afford it. But here’s the catch: many pharmacy benefit managers (PBMs) don’t care. Their business model relies on “spread pricing” - the difference between what they pay pharmacies and what they charge insurers. If a high-cost generic pays them more, they’ll keep it on the formulary, even if a cheaper, equally effective option exists. It’s not about patient outcomes. It’s about profit margins.

What gets ignored in most cost analyses

Most CEA models treat drug prices as fixed. They assume that if a drug costs $100 today, it’ll cost $100 next year. But that’s not how pharmaceutical markets work. When a patent expires, prices don’t just drop - they collapse. And the timing matters. If your analysis assumes a drug will stay expensive for five more years, but the patent expires in six months, your whole model is wrong. That’s not just a flaw - it’s a dangerous bias. The VA Health Economics Resource Center points out that analyses that ignore upcoming generic entry tend to unfairly penalize new branded drugs. Why? Because they make the new drug look expensive compared to an old brand that’s about to get crushed by generics. That skews decisions against innovation. And then there’s the issue of who pays for the research. A 2000 review in Health Affairs found that studies funded by drug companies were far more likely to say their drugs were cost-effective than independent studies. That doesn’t mean all industry-funded research is biased. But it does mean you need to look at the source - and the assumptions.What’s changing - and what’s coming

The U.S. is starting to wake up. The 2022 Inflation Reduction Act gave Medicare new power to negotiate drug prices. The 2020 Drug Pricing Reduction Act pushed Medicare Part D to prioritize lower-cost options. And the NIH released a new framework in 2023 that explicitly says: CEA must account for future generic entry. That’s a big deal. For the first time, federal health agencies are demanding that analysts build in projections for when generics will arrive - not just assume today’s price is the only price. In Europe, over 90% of health technology assessment agencies use formal CEA to make coverage decisions. In the U.S., only 35% of commercial payers do. That gap is shrinking, but slowly. The future? More drugs will lose patents. Over 300 small-molecule drugs lost protection between 2020 and 2025. That means more generics. More price drops. More opportunities to save. But only if we use the right tools.

What you can do - whether you’re a patient, provider, or payer

You don’t need to be an economist to make smarter choices.- As a patient: Ask your pharmacist: “Is there a cheaper drug that works the same way?” Don’t just accept the first generic you’re given. Ask about therapeutic alternatives.

- As a provider: Use tools like GoodRx or the VA’s National Formulary to compare prices across generics. Don’t default to the brand or the most familiar generic. Check if a different drug in the same class is cheaper and equally effective.

- As a payer or administrator: Demand that your CEA models include projected generic entry dates. Require that formularies are reviewed quarterly, not annually. Push for therapeutic substitution protocols. Stop letting spread pricing drive decisions.

Cost-effectiveness analysis isn’t just for academics. It’s a practical tool - and it’s the only way to stop wasting money on expensive generics that don’t deserve to be on the shelf.

Are all generic drugs really the same?

No. While generics must meet FDA standards for bioequivalence - meaning they deliver the same active ingredient in the same amount - they can differ in inactive ingredients, manufacturing quality, and packaging. More importantly, two generics of the same drug can have wildly different prices. One might cost $5, another $200, even if they’re chemically identical. Price doesn’t reflect quality in generics - it reflects market competition and pricing strategies.

Why do some pharmacies charge more for the same generic?

It’s mostly about how the pharmacy is paid. Pharmacy Benefit Managers (PBMs) often negotiate different prices with different manufacturers and then charge pharmacies different amounts. The pharmacy then charges you based on what the PBM tells them to charge - not what the drug actually costs. Some PBMs profit from the spread between what they pay and what they collect. This creates price inflation even for identical drugs.

Can switching to a different generic save money without losing effectiveness?

Absolutely. Many drugs have multiple generic versions made by different companies. Often, one manufacturer’s version is priced far lower than others - even if they’re the same chemical. In some cases, switching to a different drug in the same class (like switching from one statin to another) can cut costs by 90% with no loss in effectiveness. Always ask your doctor or pharmacist: “Is there a cheaper alternative that works just as well?”

Why don’t insurance plans always cover the cheapest generic?

Many plans use formularies designed by Pharmacy Benefit Managers (PBMs), not doctors or pharmacists. PBMs often prioritize drugs that give them the highest rebates or spread pricing - not the lowest cost. A drug might be more expensive but offer a bigger rebate to the PBM, so it gets preferred status. That’s why the cheapest option isn’t always on the formulary. It’s not about patient care - it’s about profit.

How can I find out if my generic drug is overpriced?

Use free tools like GoodRx, SingleCare, or the VA’s National Drug Formulary. Compare the price of your prescription to other generic versions of the same drug. If your version costs more than 2-3 times the lowest-priced generic with the same strength and dosage, it’s likely overpriced. Ask your pharmacist: “Why is this one so much more expensive?” You might be surprised by the answer.

Gray Dedoiko

December 24, 2025 AT 05:17Man, I had no idea some generics cost 15x more than others. I just grab whatever’s on the shelf at CVS. Guess I’ve been getting robbed without even knowing it.

Thanks for laying this out - I’m gonna start asking my pharmacist next time I refill my blood pressure med.

Aurora Daisy

December 25, 2025 AT 22:42Oh wow, so the American healthcare system is still somehow finding new ways to screw people over. Shocking. Absolutely shocking.

Meanwhile in the UK, we get generics for £2 and no one bats an eye. Guess we don’t need PBMs to profit off our suffering.

siddharth tiwari

December 26, 2025 AT 06:51this is all a big pharma psyop. they control the fda and the pbms and even the jama studies. you think the 15x price difference is accidental? nah. its designed. they want you dependent. they want you paying more. they dont want you to know about therapeutic substitution. its all part of the plan. they even made the va formulary look bad so youd keep buying the expensive ones. wake up.

the gov is in on it too. just wait till you see the next bill they pass.

suhani mathur

December 27, 2025 AT 07:50Oh sweetie, you think this is new? I’ve been doing this for 12 years as a pharmacist in Mumbai. We switch generics like socks - cheaper one works just fine. Americans act like they just discovered the wheel.

Also, GoodRx? That’s toddler-level research. Try comparing prices on India’s e-pharmacy apps - you’ll see prices drop 90% overnight when a new generic enters. No drama. No spreads. Just competition.

Diana Alime

December 28, 2025 AT 02:45so like… i just spent $180 on my generic adderall and now you’re telling me there’s one for $12?

oh. my. god.

i need to go scream into a pillow. or maybe just cancel my insurance. who even am i anymore.

Adarsh Dubey

December 30, 2025 AT 01:49This is a really thoughtful breakdown. The part about CEA ignoring future generic entry is critical - most models are stuck in the past. It’s like using a 2015 GPS to drive in 2025.

Also, therapeutic substitution is underused. I’ve switched patients from branded atorvastatin to generic simvastatin dozens of times. Same effect, 20x cheaper. No one complains. Why isn’t this standard?

Bartholomew Henry Allen

January 1, 2026 AT 00:05The systemic failure of cost effectiveness analysis in the United States is an affront to fiscal responsibility and rational market principles. The absence of dynamic pricing modeling in formulary decisions constitutes negligence at the institutional level. The continued reliance on static assumptions undermines public trust and inflates expenditures unnecessarily. This is not a minor inefficiency. It is a structural crisis.

bharath vinay

January 1, 2026 AT 17:06they dont want you to know this because if you knew youd stop buying their drugs and then the entire pharma industry would collapse and then the deep state would lose control and then the aliens would land and take over earth because theyre the ones who own the patents anyway

you think the fda is independent? laughable. theyre just the marketing department for big pharma. and the va formulary? a psyop. every single generic you see priced high is there by design. theyre testing your obedience.

Chris Buchanan

January 3, 2026 AT 05:50Okay, let’s get real - this isn’t rocket science. You don’t need a PhD to save money on meds. You need two things: curiosity and a phone.

Next time you get a script, open GoodRx. Compare. Ask. Push back. If your pharmacist gives you side-eye, they’re probably on commission.

And if you’re a provider? Stop being lazy. Your patients aren’t asking for the moon. They’re asking for a fair shot.

Wilton Holliday

January 4, 2026 AT 00:26Big love to the author for writing this. Seriously. I’ve seen so many patients overpay for years because no one ever told them there was a cheaper option.

Just last week, a lady was paying $210 for her generic lisinopril. Found the same thing for $14 on GoodRx. She cried. Not from sadness - from relief.

Small changes, big impact. Keep sharing this stuff. 🙏

Raja P

January 4, 2026 AT 03:57Honestly, I’m surprised this isn’t common knowledge. In India, we don’t even think twice about switching generics. It’s just how it works.

Maybe if more US docs were trained in therapeutic substitution during med school, we wouldn’t be stuck in this mess. Just saying.

Delilah Rose

January 5, 2026 AT 04:30It’s wild to think that we’ve built this entire healthcare infrastructure around the assumption that price equals quality, when in reality, for generics, it’s usually just about who has the best deal with the PBM, and who’s willing to pay the most for shelf space, and who’s got the marketing budget to make their pill look more professional on the counter, and then we wonder why people are confused and frustrated and overpaying and then we blame them for not being informed enough when really the system was designed to be confusing on purpose so that people just give up and pay whatever they’re told to pay and then we wonder why healthcare costs are so high and why no one trusts doctors anymore and why people are so angry and why we’re all so tired and why we don’t feel like we’re being treated like humans and why we just want to scream into the void and then we go back to our prescriptions and pay the price and hope it works because we don’t know what else to do anymore.

Sorry. I just needed to say all that.

Bret Freeman

January 6, 2026 AT 04:16They’re gonna come for you next. They know you read this. They know you’re asking questions. They know you’re comparing prices. They know you’re not just accepting what they tell you.

That’s why they’re making the formularies more complex. That’s why they’re hiding the real prices behind login walls. That’s why they’re suing states that try to cap insulin prices.

They’re scared. And that means you’re winning.